President Donald Trump has picked Kevin Warsh to succeed Jerome Powell as chair of the Federal Reserve. In keeping with the president’s push for lower interest rates, Warsh is expected to be more supportive of cutting the Fed’s key benchmark rate later this year.

“I have known Kevin for a long period of time, and have no doubt that he will go down as one of the GREAT Fed Chairmen, maybe the best,” said Trump in a Truth Social post on Friday.

Fed board members are nominated by the president but must be approved by the Senate. If confirmed, Warsh will take over for Powell when his term ends in May, opening the door to a potential change in the direction of monetary policy over the second half of 2026.

Warsh, a former Fed governor with a Wall Street background, has been critical of the central bank’s handling of inflation in the past and told CNBC in July that its hesitancy to cut interest rates undermined its credibility.

“Based on his past statements and actions in his previous stint as a Fed Governor, Warsh was by far the most hawkish of the four final candidates for Fed Chair,” said Brett House, an economics professor at Columbia Business School.

Trump has said that maintaining a federal funds rate that is too high makes it harder for businesses and consumers to borrow and puts the U.S. at an economic disadvantage to countries with lower rates.

Yet, after this week’s two-day Federal Open Market Committee meeting, the Fed kept its benchmark interest rate unchanged, providing little relief for Americans struggling to keep up with high borrowing costs.

The Fed’s benchmark sets the rate that banks charge each other for overnight lending, but also affects almost all consumer borrowing and savings rates.

Generally, short-term rates, like credit card rates, are closely pegged to the Fed’s benchmark. Longer-term rates, like mortgage rates, are more influenced by inflation and other economic factors.

“There was no person who was going to get this job who wasn’t going to be cutting rates in the short term,” David Bahnsen, chief investment officer of The Bahnsen Group, said Friday on CNBC’s “Squawk Box.”

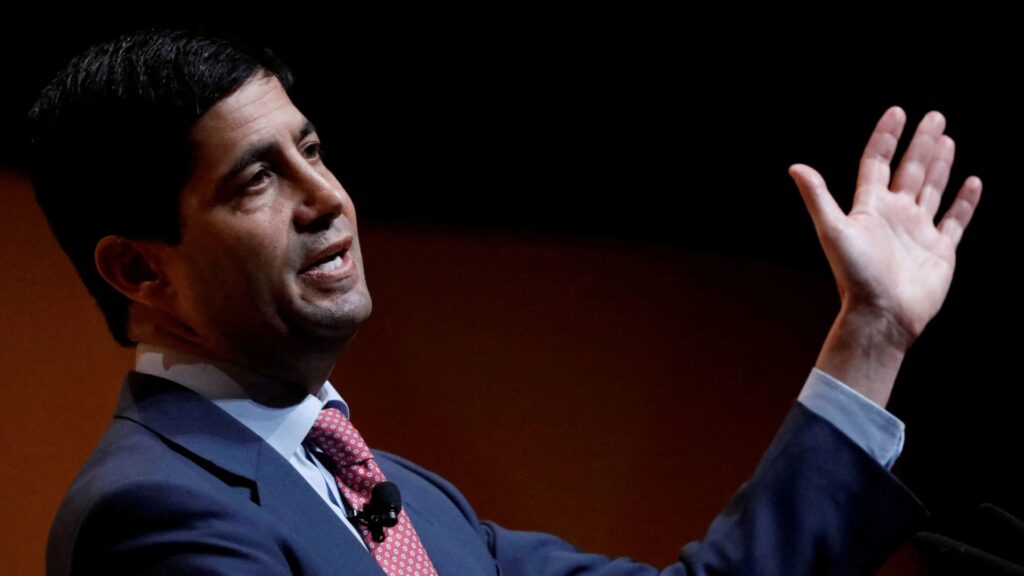

Kevin Warsh, Fellow in Economics at the Hoover Institution and lecturer at the Stanford Graduate School of Business, speaks during the Sohn Investment Conference in New York City, U.S., May 8, 2017.

Brendan McDermid | Reuters

“It’s too early to judge Kevin Warsh as Fed chair,” said Mark Higgins, senior vice president at Index Fund Advisors and author of “Investing in U.S. Financial History: Understanding the Past to Forecast the Future.”

“What is clear from history, though, is that allowing inflation to persist at elevated levels for too long makes it much harder and far more painful to extinguish later,” Higgins said.

In the 1970s, then-President Richard Nixon, pressured Fed Chair Arthur Burns to keep interest rates low — and give the economy some gas — in the run-up to the 1972 presidential election.

That set the stage for runaway inflation, economists now say. Consumer prices surged in the decade that followed and the inflation rate peaked at around 15% in 1980, which remains the highest rate since the post-World War II period.

The Fed ultimately, under new leadership, raised interest rates to punishing levels to rein in inflation, leading to surging borrowing costs in the ’80s.

“The message to households is uncomfortable but important,” Higgins said. “Accepting shorter, more acute economic pain now is preferable to prolonged inflation that continues to erode purchasing power. History is unambiguous on this point.”

Subscribe to CNBC on YouTube.