“Can we go to the Galapagos Islands for spring break?”

“No, we can’t afford it.”

If this exchange sounds familiar, it’s because sooner or later, your child will ask for something that blows past your budget.

Once kids start school, they become aware of the trips, toys, cars, and experiences other families have. Maybe they see a Cybertruck at drop-off. Maybe a friend just went on a luxury vacation. Maybe they want a backyard pool.

When you say no to one of these requests, they’ll inevitably ask, “Why?”

This moment can feel uncomfortable. It can be difficult to deny your child something they want. Their request might also trigger old memories of lack, or spark feelings of shame that you can’t provide what others have. Those emotions make it easy to get irritated or shut them down with a reflexive, “We can’t afford it.”

But as a financial psychologist, I suggest eliminating this phrase from conversations with your kids. Here are three reasons you should never tell your child, “We can’t afford it” — and what to do instead.

1. You’re probably lying

It’s not entirely true, and kids can sense that. Let’s be honest, if you were desperate, you probably could come up with the money. You could, for example:

Take out a home equity line of credit Sell your house or belongingsMax out your credit cards Get a second or third job and work nights, weekends, and holidays

The point is, unless your child is asking for a private jet, you probably could find a way to make it happen. So “We can’t afford it” usually falls short.

2. It creates scarcity-based money scripts

Imagine a child who’s never allowed to have candy. What do you think might happen on their 18th birthday? They go on a sugar bender. Money works the same way.

If your child grows up hearing, “We can’t afford it,” they may internalize a sense of financial scarcity. When they eventually enter adulthood and are offered credit cards, student loans, and easy financing, the emotional response may be: “Now I can finally get what I never had.” This can lead to overspending, credit misuse, and lifelong financial stress.

DON’T MISS: The ultimate guide to teaching your kids about money

Telling a child why you’re not buying something is different. Instead of implanting the belief that money is scarce, you can focus on teaching them about the reasons you choose to prioritize other things.

3. You miss out on a powerful teaching opportunity

When your child asks for something expensive, it’s your chance to explain:

Why certain expenses aren’t in the budgetWhat your family is saving forWhy you’re prioritizing long-term goals over short-term thinkingHow overspending on cars, vacations, or houses leads many people into financial troubleWhy delayed gratification matters

If they ask for something unrealistic, like an island in the Caribbean, don’t shut them down. Use it as inspiration. Talk about entrepreneurs and investors who build wealth big enough to afford dreams like that, and how your child can work toward big goals, too.

So what exactly should you say instead?

Research shows that kids who grow up to be good with money are more likely to come from homes where it was discussed openly.

Instead of cutting off the conversation with an abrupt, “We can’t afford it,” try saying: “We could do that, but we’re choosing to spend our money on these things instead, and here’s why.”

Then explain your reasoning. Maybe you’re:

Paying off debtSaving for a homeInvesting for retirementChoosing to work less so you can spend more time together

Share your family money values. Tell them what matters most to you. Explain how saving, investing, and making thoughtful spending decisions lets you live the life you want and helps you achieve your goals.

These conversations will help your child build a healthy relationship with money instead of one rooted in shame or scarcity.

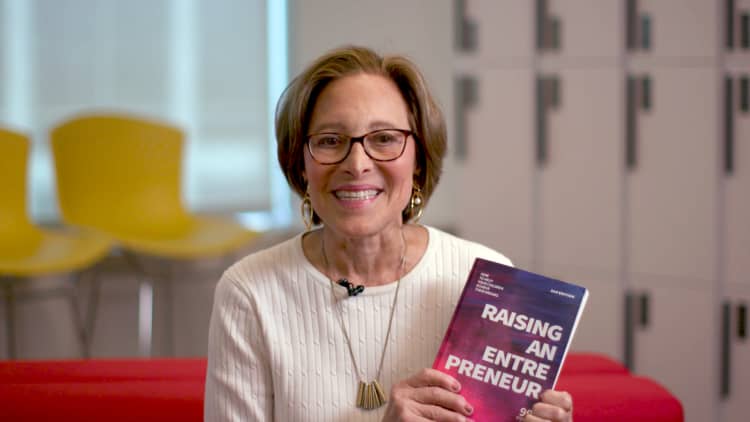

Brad T. Klontz, Psy.D., is a financial psychologist, professor, and certified financial planner who has studied the psychology of money for more than 15 years. He helps clients understand and overcome their subconscious beliefs and patterns that affect their financial behaviors and decisions. Klontz is a member of the CNBC Digital Financial Advisor Council and is a featured expert in the Smarter course “How To Raise Financially Smart Kids.”

Want to give your kids the ultimate advantage? Sign up for CNBC’s new online course, How to Raise Financially Smart Kids. Learn how to build healthy financial habits today to set your children up for greater success in the future. Use coupon code EARLYBIRD for 30% off. Offer valid from Dec. 8 to Dec. 22, 2025. Terms apply.