Washington reportedly is considering allowing the export of Nvidia’s H200 graphics processing units (GPUs) to China, but Chinese commentators warn the offer could amount to “sugar-coated bullets” that would slow the long-term growth of China’s artificial intelligence chip market.

The United States Department of Commerce is reassessing its prohibition on H200 sales, Reuters reported November 21, citing sources familiar with the discussions. But the report emphasized that any decision remains fluid. The White House and Commerce Department offered no comment, and Nvidia also declined to address the review directly.

The H200, introduced two years ago, is estimated to deliver roughly double the performance of the H20, the most advanced AI chip currently permitted for export to China. Many AI firms in the US are still using H200 chips to train their large language models (LLMs), although some are upgrading to Nvidia’s Blackwell series, such as the B200 chips.

The US Department of Justice on the same day the news report came out announced charges against four individuals accused of conspiring to export Nvidia’s high‑end GPUs illegally to China. They are Hon Ning Ho (Mathew Ho), Brian Curtis Raymond, Cham Li (Tony Li) and Jing Chen (Harry Chen).

According to the indictment, the conspiracy ran from September 2023 to November 2025 and involved four separate export attempts routed through Malaysia and Thailand to China. In the first two, the defendants allegedly succeeded in shipping 400 Nvidia A100 GPUs to China between October 2024 and January 2025.

The third and fourth attempts involved 10 Hewlett Packard Enterprise supercomputers equipped with H100 GPUs and 50 standalone H200 GPUs. Those two attempts were disrupted by law enforcement before completion, according to the charging documents. Court records outlined a funding trail centered on US$3.89 million in wire transfers sent from buyers in China.

This kind of violation of US chip export rules is not an isolated incident. In February 2025, authorities in Singapore charged three men, two Singaporeans and one Chinese national, with fraud for allegedly helping ship Nvidia’s high-end chips to Chinese AI firm DeepSeek in 2024.

In a separate case, four Chinese technology engineers flew from Beijing to Kuala Lumpur carrying 60 hard drives containing enough data to train multiple large language models, the Wall Street Journal reported in June 2025.

It remains unclear whether Washington’s apparent shift stems from the growing number of smuggling cases or, rather, from a broader recalibration of its principles on chip export controls.

What is clear is that some stock investors moved quickly to reduce their exposure to Chinese semiconductor firms. Semiconductor Manufacturing International Corp (SMIC) slid as much as 7.3% in Hong Kong trading on Monday, while Hua Hong Semiconductor dropped 5.2%. Although both counters later stabilized, they still finished the day below last Friday’s close – even as the Hang Seng Index advanced 2%.

‘Stay cautious!’

Most Chinese commentators have urged Beijing to remain cautious about permitting Nvidia to make profits from and dominate the Chinese markets.

“The H20 has already lost its appeal in China – many domestic chipmakers can now offer alternatives,” says a Guangdong‑based columnist writing under the pen name “Ya Gang.” “If the US wants to win back Chinese customers, it will have to relax its H200 export controls.”

“By relaxing the export of the H200 chips to China, the US government can get a cut in Nvidia’s China income,” he says, adding that Nvidia had agreed to hand over 15% of the China sales of its H20 chips to the US government.

“Besides, by keeping Nvidia firmly planted in the Chinese market, the US can continue to squeeze Chinese chip makers and keep us dependent on American hardware. That’s the real sugar‑coated bullet.”

Because the H20 is a downgraded version of the H200, any security issues found in the H20 could also appear in the H200, he adds, referring to alleged “back doors” that would allow Nvidia to remotely monitor and control its GPUs overseas.

The term “sugar‑coated bullet” originated from Chinese leader Mao Zedong’s March 1949 address to the Second Plenary Session of the Seventh Central Committee, delivered on the eve of the Communist Party’s victory in the civil war. Mao cautioned that while the Chinese Communist Party had defeated its armed enemies, some cadres might still fall to the “sugar‑coated bullets” of the bourgeoisie – a reference to temptations wrapped by capitalists in flattery, comfort and complacency.

“Local AI‑chip makers accounted for 35% of China’s market in the first half of 2025, with expectations that the share will exceed 40% by year‑end,” says a Yunnan‑based columnist. “Alibaba, Tencent and China Mobile are all buying domestic solutions at scale now. This is not just because of Beijing’s policy pressure, but because local chips offer real advantages in power efficiency, localization and supply‑chain security.”

He adds: “The US now faces a dilemma. If it maintains a total blockade, it hands China’s market to local competitors. But if it fully opens up, it weakens its own technology‑containment strategy. The relaxation around the H200 is simply a compromise that aims to reassure Nvidia while keeping the appearance of a high‑end ban.”

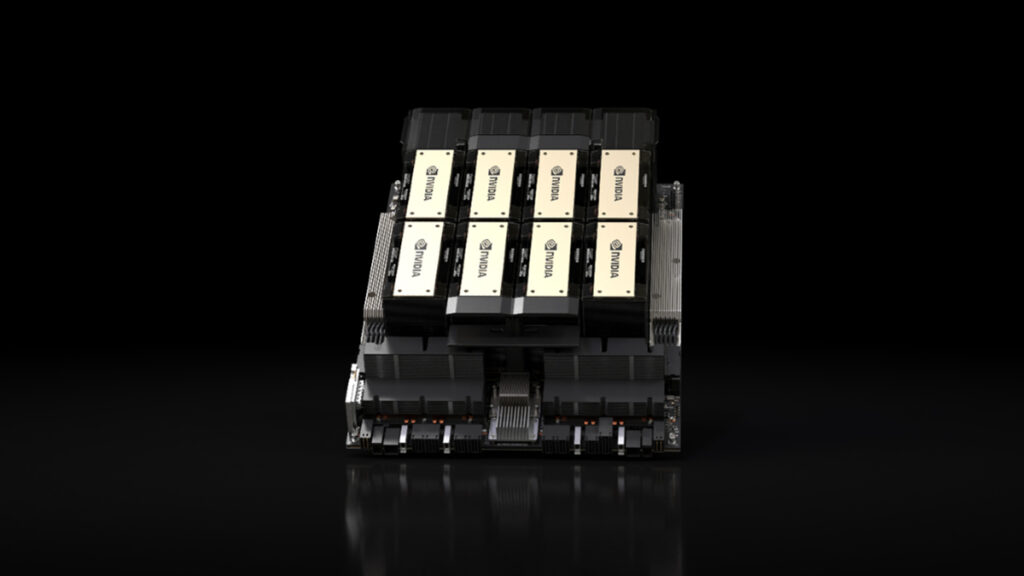

Nvidia’s B200 chips

Based on the Hopper architecture, the H200 offers 141 gigabytes (GB) of HBM3e memory at 4.8 terabytes per second (TB/s), nearly double the capacity of the H100 and with 1.4 times more memory bandwidth, according to Nvidia. The H200 boosts inference speed by up to two times compared with the H100 when handling LLMs like Llama2. H20 is a modified, lower-compute version of the H100, optimized for AI inference workloads.

Chinese media said Huawei’s Ascend 910B now matches the H20, and in some scenarios, Cambricon’s Siyuan 690 and Biren’s BR100 can even pull ahead. They said that although the Ascend 910C still trails Nvidia chips, it can scale up to 384 cards in one cluster, compared with a 72‑card limit for the H200.

The Trump administration in July approved exports of the H20 chips to China, but Chinese pundits immediately dismissed them as “poisoned wine,” saying the chips would lock domestic AI firms deeper into Nvidia’s ecosystem. Beijing soon raised concerns about the H20’s alleged back doors.

Nvidia Chief Executive Jensen Huang said in October that the company’s share of China’s advanced AI‑accelerator market had fallen from roughly 95% to zero.

Some observers say that if Washington approves H200 exports to China, it may also end up scrapping restrictions on older chips like the H100 and A100. They also note that if Beijing accepts the H200, it could weaken its rationale for probing alleged back doors in the H20. These developments would help improve Nvidia’s sales performance in China.

However, some Chinese writers then turn to a sharper question: Why can Middle Eastern buyers obtain Nvidia’s newest Blackwell‑series chips, such as the B200, while China cannot? They say it’s unreasonable that China is one of the world’s largest AI markets but is restricted to older AI chips.

On November 20, the US Commerce Department approved exports of up to 70,000 Blackwell‑architecture chips to Saudi Arabia’s Humain and the UAE’s G42. Nvidia’s DGX B200 platform delivers three times the training performance and 15 times the inference performance of previous-generation systems powered by the H100.

Read: China reportedly caught reverse-engineering ASML’s DUV lithography

Follow Jeff Pao on Twitter at @jeffpao3