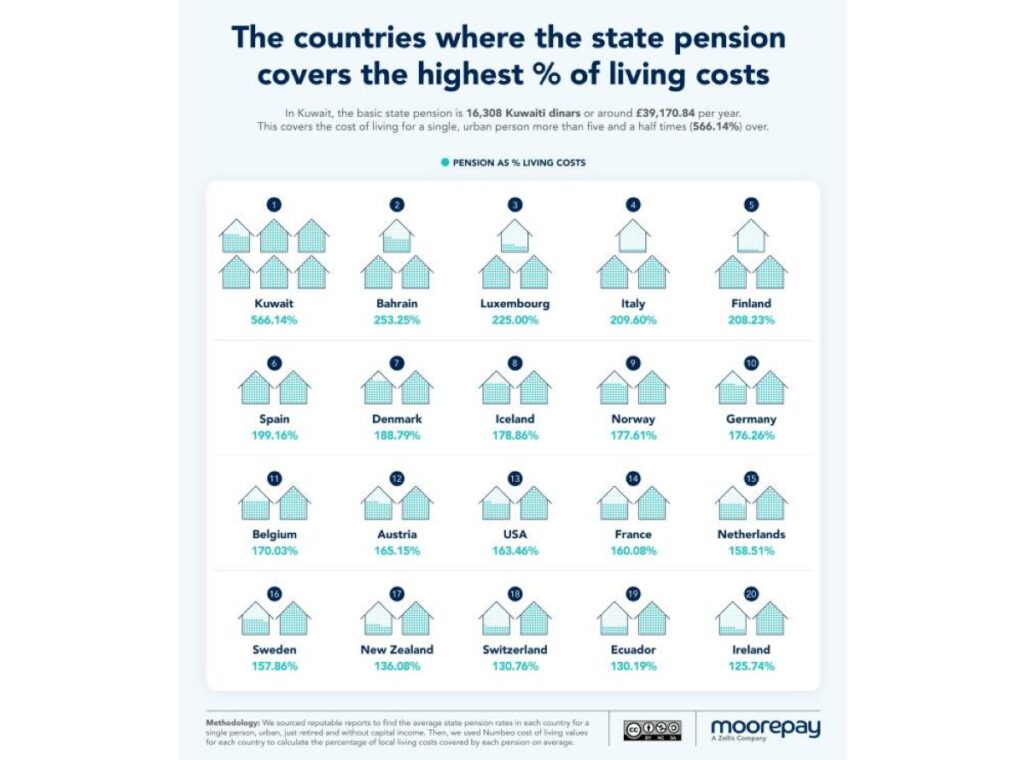

KUWAIT: New research showed that Kuwait ranks first globally for state pension generosity, leaving retirees with by far the largest financial surplus in the world after basic living costs are covered. According to UK-based payroll company Moorepay, Kuwait Pension Covers 566 percent of living costs, which is considered the highest in the world. The research analyzed state pensions across 85 countries, comparing how far each system stretches once essential expenses are paid. According to the study, the average Kuwaiti state pension stands at KD 16,308 per year, which is equivalent to 566% of the country’s annual cost of living, or nearly 5.7 times what is needed to cover basic expenses.

The pension, calculated as a percentage of an individual’s late-career salary, varies across sectors, averaging KD 1,450 dinars per month in the government sector, KD 1,850 in the oil sector, and KD 1,650 in the private sector. The analysis found that after covering essential living costs, the average Kuwaiti pensioner has a surplus of more than double that of Luxembourg and almost 16 times higher than the UK, which ranks 21st in pension surplus globally.

Several retirees expressed skepticism to Kuwait Times over the recent study, arguing that the reality of living conditions does not reflect the study’s findings amid debts, rising living costs, and disparities in pension salaries. Retiree Adhari Nasser Al-Wawan said that the study’s results were “incorrect,” questioning the methodology used. She emphasized that a large segment of retirees, particularly government employees, are burdened with debts and installment payments due to differences in salaries between institutions despite similar qualifications.

She noted that one of the positives of the pension system is the “timely” disbursement of pensions, but added that the salary does not cover basic needs, forcing retirees to rely on advances just a few days after receiving their pension.

Al-Wawan added that the standard of living declines after retirement due to certain laws, such as limiting borrowing to 30 percent. She highlighted that the heaviest expenses include children’s school fees, especially for those who have not completed their education, car installments, domestic worker salaries, and daily expenses, as well as emergencies like home or car repairs, advising young people not to rely solely on government pensions but to focus on saving and additional work.

Similarly, retiree Wadha Al-Bati, in her forties, said the main positive aspect of the pension system is the ability to focus on circumstances that led to retirement, such as illness or caring for disabled family members, stressing that the pension never covers basic needs, given high prices and financial obligations, including the reduced borrowing limit. Al-Bati explained that her standard of living changed after retirement due to the loss of bonuses, committee allowances, and overtime that previously supplemented salaries. She pointed out that those general expenses, children’s education, and medical costs – especially when some treatments are unavailable in government hospitals – create a heavy burden.

In his turn, Retiree Jaber Al-Houli, 47, said that the study looks inaccurate, noting that countries like the UAE and Qatar provide better pension systems, confirming that the pension does not cover needs, particularly for those without housing, and added that the living style changes after retirement due to the loss of many allowances. Al-Houli said that he believes the pension system could remain sustainable for future generations as long as it is not subject to corruption, but he does not advise young people to rely solely on pension income, urging them to find additional sources of revenue. He also pointed to large disparities in pension salaries among retirees, saying there is no clear justice ladder in pensions.

Meanwhile, retiree Adel El-enzi, 53, said that the system doesn’t provide a decent living, appealing to the Prime Minister and the Central Bank of Kuwait to reconsider the timing of bank deductions for retirees’ financial obligations. He explained that banks deduct payments starting on the 5th of each month, while salaries are paid on the 10th, leaving retirees without money for several days, suggesting adjusting deductions to begin on the 11th of the month.

The retiree also suggested that retirees could be engaged on a reward basis to benefit from their experience. He proposed a solution to the housing crisis, recommending that retirees be granted a government-subsidized loan of KD 52,000, in addition to the existing KD 80,000 housing loan, instead of relying on banks. Beneficiaries of the government loan would be ineligible for a bank loan to ensure fairness and protect public funds. The retiree concluded that such measures would help retirees live with dignity after years of service and improve their overall living conditions.