European markets were mixed on Wednesday, as traders gear up for a quarterly earnings report from chipmaker Nvidia.

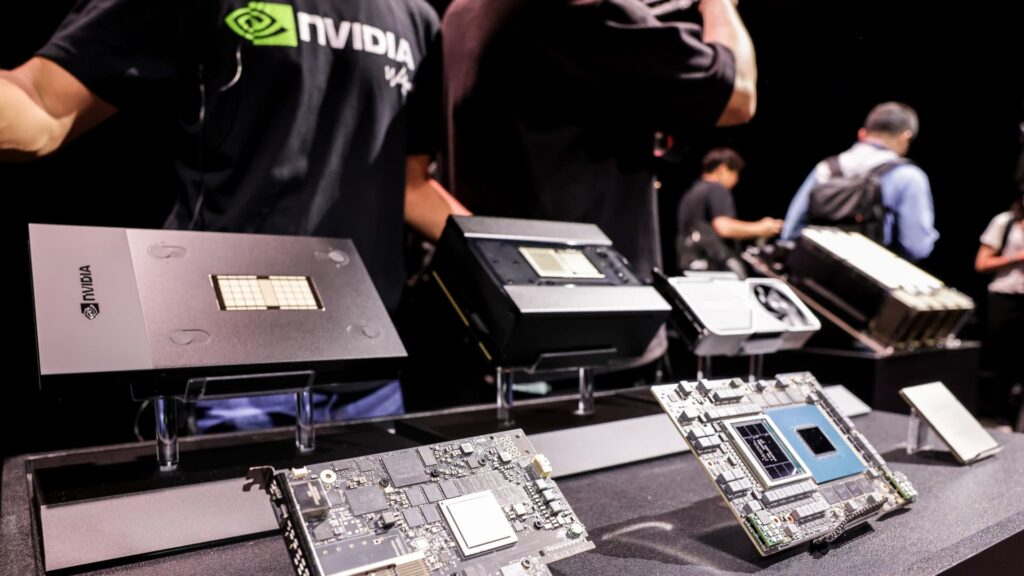

The Nasdaq-listed stock has become a bellwether for the global technology sector, particularly regarding the progress of the artificial intelligence boom, as its major corporate customers include Microsoft, Google, Meta and Amazon.

Its value has soared in recent years, giving it the biggest weighting in the S&P 500 and an outsized influence on U.S. market performance. The company will report after U.S. markets close on Wednesday.

France’s CAC 40 index rebounded 0.4% following a 1.6% decline on Tuesday. Investors were spooked by the potential for a fresh period of political instability and inability to pass a 2026 budget after opposition parties said they would not back Prime Minister Francois Bayrou in a confidence vote next month.

The pan-European Stoxx 600 also rebounded closing 0.1% higher. It’s been a relatively strong month overall for the regional index, which has gained about 1.6% for its best month since May’s global equity rally.

Stoxx 600 index.

Asia-Pacific markets traded mixed on Wednesday, after data showed China’s industrial profits slipped 1.5% year on year in July, a notable recovery following months of steeper declines.

In India, where markets are closed for a holiday, steep U.S. tariffs totaling 50% are set to take effect.

— CNBC’s Lee Ying Shan contributed to this story.