When counseling clients, financial advisors often draw a distinction between investing and speculation.

Investing, they say, generally involves consistently buying into a broadly diversified swath of the market and letting compounding interest do its work over the course of decades. “Real investing is boring. It’s like watching paint dry,” Ramit Sethi, author of “I Will Teach You To Be Rich” told CNBC Make It in July 2023.

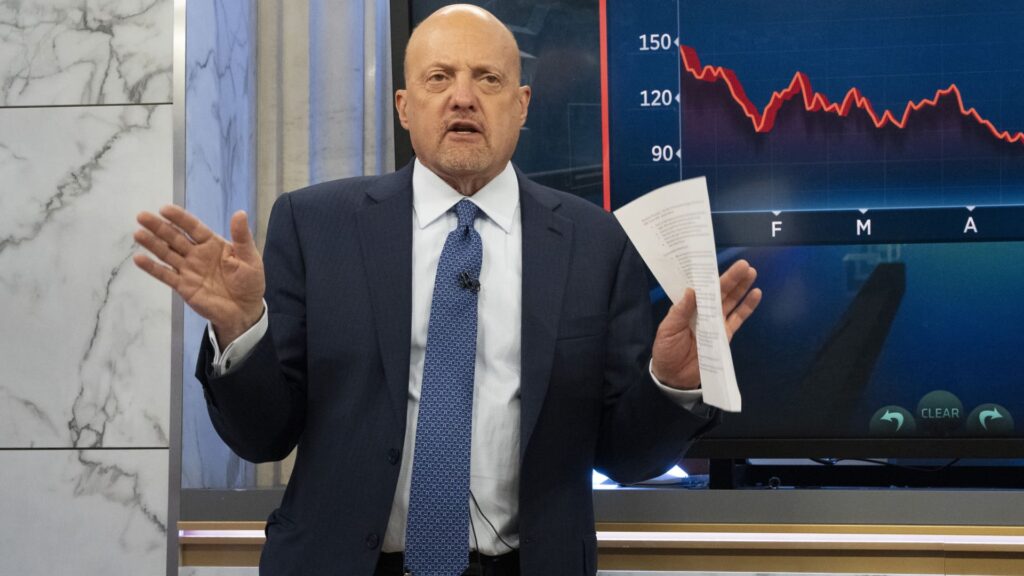

Speculation, meanwhile, is nothing if not exciting: A speculator buys assets that offer a chance at sky-high returns and substantial risk of loss. And when it comes to building wealth, taking on a little extra risk has the potential to go a long way, says Jim Cramer, host of CNBC’s “Mad Money” and author of “How to Make Money in Any Market.”

“I believe in speculation. I don’t think that speculation is bad,” Cramer tells CNBC Make It. “I want you to speculate wisely.”

DON’T MISS: The ultimate guide to starting a business—everything you need to know to be your own boss

Cramer’s approach to portfolio building combines diversification and investment in individual stocks, a system he also outlines in his book. About 50% of your investments, he says, belong in passive mutual funds or exchange-traded funds that track a U.S. stock index, like the S&P 500.

Spread the other half, roughly, across a handful of stocks. Most of those, he says, should be in high-quality growth stocks. One, however, should be speculative, he says — two if you’re early in your investing career. Speculation can be an essential way for younger investors to boost their chances at building long-term wealth, he adds.

“The No. 1 thing people who are young should do with their money is: They should find speculations,” Cramer says.

Those stocks don’t need same fundamental strength as the other names in your portfolio, he notes. They may lack impressive profits or high valuations. They could even be plays on a long-term, world-changing theme you believe in.

“Maybe you believe in quantum [computing]. Maybe you believe in nuclear. Maybe you think that there’s something in crypto that is really, really special,” says Cramer.

Cramer’s strategy of taking a small portion of your portfolio to swing for the fences can pay off: Just ask anyone who took an early flyer on Tesla or Nvidia if they wish they’d stuck with a more diversified approach.

But speculating wisely means going into it with a full understanding of the risks, and the potential effect of a loss on your overall portfolio, Cramer says. You could easily lose every dollar that you put into a speculative investment. If that happens, youth can be an advantage; you’ll have time to make up a total loss in a relatively small portion of your holdings.

“You’re young and you got your whole life to make that money back,” he says.

Some might call that approach reckless, Cramer acknowledges. But giving yourself a chance at life-changing returns is worth the risk, he says.

“That’s not reckless. It’s prudent,” says Cramer.

Upgrade to an annual CNBC Investing Club membership today and claim your free, signed copy of Jim Cramer’s new book, “How to Make Money in Any Market.” (See terms and conditions for complete offer details. This promotion is available only while supplies last. See the full disclaimer here for important limitations and exclusions.)

Plus, sign up for CNBC Make It’s newsletter to get tips and tricks for success at work, with money and in life, and request to join our exclusive community on LinkedIn to connect with experts and peers.