The relaxation of the United States’ export controls for Nvidia’s H20 chips won brief applause in China – while raising longer-term concerns about whether Chinese firms will over-rely on foreign artificial intelligence chips.

During a trip to China on July 15, Nvidia Chief Executive Jensen Huang said in a press conference that the company will resume H20 chip sales to China, now that the US government has indicated it will soon grant export licenses.

“I hope to get more advanced chips into China than the H20,” Huang said. “Technology is always moving on. Today, Hopper’s terrific, but some years from now, we will have more and more and better and better technology, and I think it’s sensible that whatever we’re allowed to sell in China will continue to get better and better over time as well,” he said.

He also took the opportunity to praise Huawei’s achievements in making AI chips.

However, some Chinese commentators viewed the development as unfavorable for China’s chip-making sector.

“This is not a simple lifting of the export restrictions, but a carefully designed measure for the United States to maintain its technological blockade against China,” a Guangdong-based columnist says in an article.

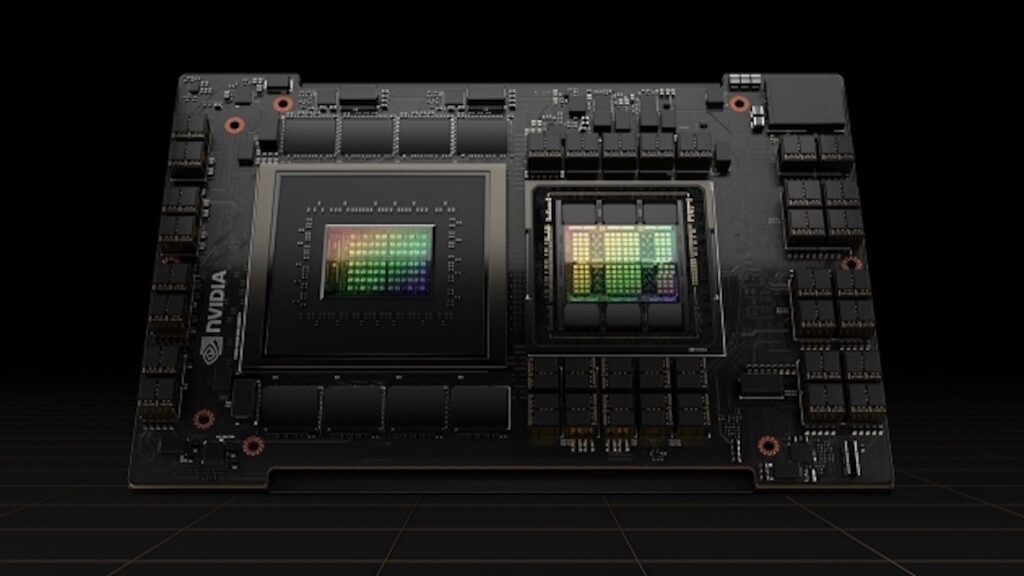

“The H20’s FP16 computing power is only 15% of H100, while its NVLink bandwidth is reduced from 900GB/s to 400GB/s. The chip’s transformer engine (TE) is completely deleted,” he says. “Such a design ensures the chip’s AI inference ability and reduces its AI training capability, perfectly implementing the United States’ strategy of blocking high-end chips, but not mid-end ones, to China.”

“By limiting the key performance of H20, the US can maintain its blockade of high-end computing power while handing Chinese companies a glass of ‘poisoned wine,’” he says.

In Chinese idiom, a person who “drinks poisonous liquor to quench thirst” knows that it will kill him, in the long run, but he can’t do anything to change the situation. Applied to Chinese technology companies, this means that the domestic chipmakers can benefit from foreign AI chips in the short term but will miss an opportunity to grow and establish an ecosystem.

An AI firm needs tens of thousands of Nvidia’s high-end chips, such as A100 or H100, to train a large language model (LLM) like ChatGPT. Once an LLM is developed, the company can use slower graphics processing units for inference tasks.

In an article published by 36kr.com, a columnist using the pseudonym “Silicon Rabbit” says that Nvidia’s Huang made a subtle and cunning move to help the US curb China’s chip sector.

“Imagine that someone sold you a Ferrari with a powerful V12 engine, but downgraded its gas pipe, gearbox and wheels. This car can run normally on straight roads, but it faces limitations when continuously speeding up or making sharp turns,” he says, attributing the metaphor to an unnamed senior software engineer who had participated in the Hopper architecture’s performance optimization project.

He says that the computing power of a single H20 chip is far below that of the H100, while a reduced interconnect bandwidth means a significant reduction in AI training capability.

“AI training is similar to having tens of thousands of people work together, which requires fast information exchanges,” he says. “A low interconnect bandwidth means that people communicate slowly, resulting in a low thinking efficiency.”

He says that the H20 chip cannot be used to train trillion-parameter LLMs.

“The H20 generously offers 96 gigabytes of the third-generation high bandwidth memory (HBM3) – higher than the H100’s 80GB HBM3e. However, the H20’s memory bandwidth is only 4.0 terabytes per second (TB/s), lower than the H100’s 4.8 TB/s,” he says. “It is like someone giving you a bigger table to read more books, but making it harder for you to take books from the shelves.”

The writer says the relaxation of the export rules for the H20 is aimed at permitting the US to control the pace of China’s AI development precisely.

Huawei’s 910B

Reuters, citing sources familiar with the situation, reported that Chinese internet giants, including ByteDance and Tencent, are submitting applications for the H20 chip. ByteDance denied the report. Tencent did not respond to Reuters’ request for comment.

On April 9, 2025, according to Nvidia, the US government informed the company that a license is required for exporting its H20 products into the Chinese market. The new curb was a part of Washington’s countermeasures after China retaliated against the Trump administration’s reciprocal tariffs.

In announcing results for the three months ended April 27, Nvidia said sales of H20 products were US$4.6 billion before the new export licensing requirements took effect. It said it could not ship an additional $2.5 billion of H20 revenue.

After US and Chinese officials held meetings in London on June 9, both sides agreed to de-escalate the trade war. Beijing decided to ease export controls on niche metals to the US. In return, the US would allow Chinese firms to use its chip-making software and export parts for China’s C919 flight engines. And now, the US will enable Nvidia to ship the H20 chips to China.

A Guangdong-based columnist says Nvidia’s H20 chips will enjoy an advantage in the Chinese market, although Huawei’s Ascend 910B chips perform better in many aspects of AI training. He says Nvidia’s CUDA platform is more advanced than Huawei’s MindSpore framework, making customers reluctant to use non-Nvidia chips.

For example, he says that Alibaba prefers to use the H20 chips to migrate its existing AI system, while the Ascend 910B chips may target state-owned enterprises.

A Beijing-based writer expects Nvidia’s CUDA platform to continue enjoying an 80% market share in China, as it would be expensive for companies to switch to new platforms.

On July 18, a spokesperson for the Chinese Ministry of Commerce said the US should abandon its “zero-sum mentality” and further remove a series of trade restrictions targeting Chinese companies that the ministry considered unreasonable.

The spokesperson stated that in May, the US unveiled export control measures targeting Huawei’s Ascend chips, tightened restrictions on Chinese chip products following unfounded accusations, and intervened in fair market competition with administrative measures. The spokesperson urged the US to work with China to correct erroneous practices through equal consultation.

Meanwhile, the Trump administration increased its efforts to prevent China from obtaining Nvidia’s high-end chips. It urged Malaysia and Thailand to curb transhipments of Nvidia’s AI chips to China.

On July 14, the Malaysian government announced that export, transshipment or transit of high-performance AI chips of US origin will require a trade permit. Companies must notify the government at least 30 days before shipping Nvidia’s high-end chips elsewhere.

Read: US plans to tighten AI chip export rules for Malaysia, Thailand