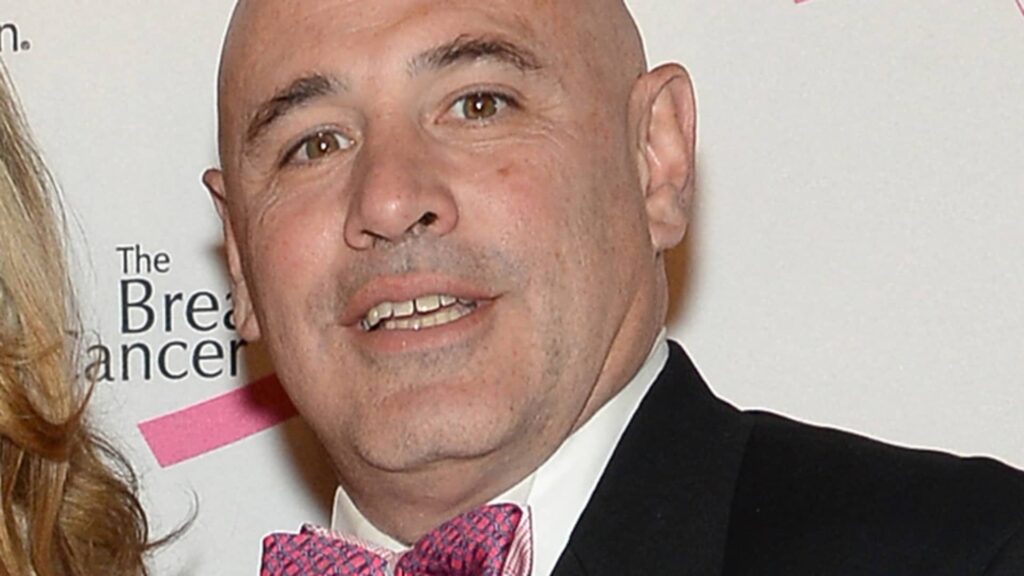

Robert Citrone, a billionaire hedge fund manager who enjoyed 50% back-to-back annual returns, is boldly forecasting a 10% correction in the stock market. The Discovery Capital Management founder and portfolio manager believes President Donald Trump ‘s tariff fights with various countries will make for a bumpy road, stoking market volatility and triggering a significant drawdown in stocks. “Tariffs are messy,” Citrone said Tuesday on CNBC’s ” Squawk Box .” “The discussions with Europe and Japan and others are still very difficult; I think we’re doing the right things and trying to get fair trade, but to get there, it’s difficult, structurally tough … I don’t think it’s going to be just smooth sailing.” The S & P 500 has rebounded from a near 20% sell-off in April, going on to score a record high on Friday and again on Monday, wrapping up a stunning second quarter. Investors are now bracing for a July 8 deadline when a suspension of so-called reciprocal tariffs is due to expire, while listening for companies’ guidance on the impact of higher duties in the coming earnings season. .SPX YTD mountain S & P 500 in 2025. No rate cuts? Contrary to the wide belief that the Federal Reserve will cut interest rates twice this year, Citrone thinks the central bank will actually hold rates steady due to stubborn inflation. “I think they stay the course cutting rates. I just don’t see, and I’ve been saying to our investors for six months, there’s no way the Fed’s cutting rates this year because inflation is too sticky … we still have $2.5 trillion that we printed since Covid that we haven’t taken out of the system,” he said. The Fed’s latest forecast showed it sees inflation rising again, to above 3% this year, amid the uncertainty around Trump’s trade policies and intensifying geopolitical risk. Still, the so-called dot plot — individual Fed members’ expectations for rates — showed officials see their benchmark lending rate falling to 3.9% by the end of 2025, equivalent to two reductions later this year. Citron said the 10-year Treasury yield could shoot up again to a range between 5% and 5.25% between now and the end of the year as inflation picks back up. Bitcoin correction? The hedge fund manager made another bold prediction on bitcoin, seeing the world’s largest cryptocurrency selling off along with the broader market in the next few months. Citrone revealed that he sold half of his bitcoin position on Monday when the cryptocurrency was around $107,000. “Bitcoin, I think, will correct with the market here in the next few months,” he said. “I don’t like the fact that bitcoin trades with the market.” Bitcoin hit a record high near $112,000 in late May amid easing trade tensions between the U.S. and China and the Moody’s downgrade of U.S. sovereign debt , which highlighted alternative stores of value like bitcoin and gold. The token is trading around $106,428 on Tuesday.